|

In a sweeping intervention in the markets since the great depression, the Bush administration has urged Congress to grant it far-reaching emergency powers to buy hundreds of billions of dollars of distressed mortgages from the $3.4-trillion money market sector by creating a federal-backed investment vehicle into which America's banks can dump toxic mortgage-backed securities.  The Congress will have to be pass the US government's bailout package, which could be enacted as a law as early as Wednesday. The Congress will have to be pass the US government's bailout package, which could be enacted as a law as early as Wednesday.

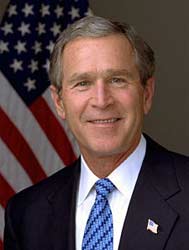

Treasury secretary Henry Paulson said the upfront cost of the proposal could easily be $500 billion, though commentators feel that the figure could swell to $1 trillion although there was no indication of what the government would get in return for the federal assistance. It has also not indicated how it would assign a value to these assets although opinions have come from many sources that the securities could be determined through an auction that could be underwritten by the government, and ultimately sold back to the market. President Bush, has approved a provisional $50-billion plan to guarantee money-market funds against losses that could emanate from the share price falling below a dollar. Since millions of Americans have their pension and savings in the money-market funds, short-selling of stocks has been banned in 799 financial stocks for the next 10 days by the Securities and Exchange Commission in concurrence with the UK's Financial Services Authority. Short sales are essentially a bet that a company's stock will go lower but some unscrupulous short-sellers spread rumors and misleading information push prices down. Short selling has been blamed for accelerating the plunge in stock prices of financial institutions. Others say short selling provides liquidity in the market and helps control valuation of stocks. "Pivotal moment" Bush, commenting on the bail out package said,the bailout was a "pivotal moment" for America's economy. "In our nation's history, there have been moments that require us to come together across party lines to address major challenges. This is such a moment." Money market funds are basically mutual funds that invest in short-term government securities, certificates of deposit, asset-backed commercial paper and other highly liquid securities. Since the beginning, these funds have yielded interest on savings without disrupting the principal amount and, most important, it was paid in dollars. The payment in dollar was not assured by any law but had become a currency of belief among money fund investors as it assured them that each dollar invested in a money fund would always fetch its original full price. Scared investors had pulled their money out from the money market assets fund which fell in the week ended September 17, by a record $169.03 billion. These steps were taken so as to infuse confidence in the investors who otherwise would further withdraw their holdings from the $3.5 trillion investments in money-market funds, thereby reducing corporation's short-term funding source. Treasury secretary Paulson and Federal Reserve chairman Ben Bernanke told lawmakers that the financial system had been dangerously close to collapse and that failure to pass a broad rescue plan would lead to nothing short of disaster. Markets jubilant When news broke out of the rescue plan by Washington, the markets responded positively with the Dow Jones industrial average closing up 369 points, or 3 per cent, and Standard & Poor's 500 up 49 points, or 4 per cent. The FTSE 100 also surged by nearly 8 per cent to 5,2678, its largest ever one-day rise since 1987. In a week of financial turmoil, the federal government already has pledged more than $600 billion in the past year to bail out, or help bail out, some of the big financial institutions in Wall Street. The Federal Reserve lent $85 billion to insurance giant American International Group to prevent its collapse. Two icon investment banks, Lehman Brothers and Merrill Lynch, fell, one to bankruptcy, the other in a government-brokered takeover. Just a week earlier government took over mortgage giants Fannie Mae and Freddie Mac and the rescue of investment bank Bear Stearns in March. A federal takeover such as the one now, has precedents when President Hoover formed 'The Reconstruction Finance Corp' during the depression era in 1932 to revitalize the market by giving loans to banks and other businesses. Moving closer to 1989, the government undertook to solve the savings and loan crisis by creating 'the Resolution Trust Corp' which sold bad assets such as real estate and securities, of failed savings and loans and other thrift institutions, that had been taken over by their deposit insurance fund. In the process of six years RTC was able to stabilise the system but it took $125 billion in taxpayer money which would work out to approx $200 billion today.

|